The smart Trick of Fortitude Financial Group That Nobody is Discussing

Wiki Article

See This Report about Fortitude Financial Group

Table of ContentsUnknown Facts About Fortitude Financial GroupThe Facts About Fortitude Financial Group RevealedWhat Does Fortitude Financial Group Do?About Fortitude Financial GroupFortitude Financial Group Things To Know Before You Get This

Keep in mind that several experts will not handle your properties unless you meet their minimum needs. When picking a monetary expert, find out if the specific follows the fiduciary or suitability standard.If you're seeking monetary advice however can not manage a financial consultant, you could consider employing a digital investment consultant called a robo-advisor. The broad area of robos extends systems with access to financial experts and financial investment monitoring. Equip and Improvement are two such examples. If you're comfy with an all-digital platform, Wealthfront is one more robo-advisor choice.

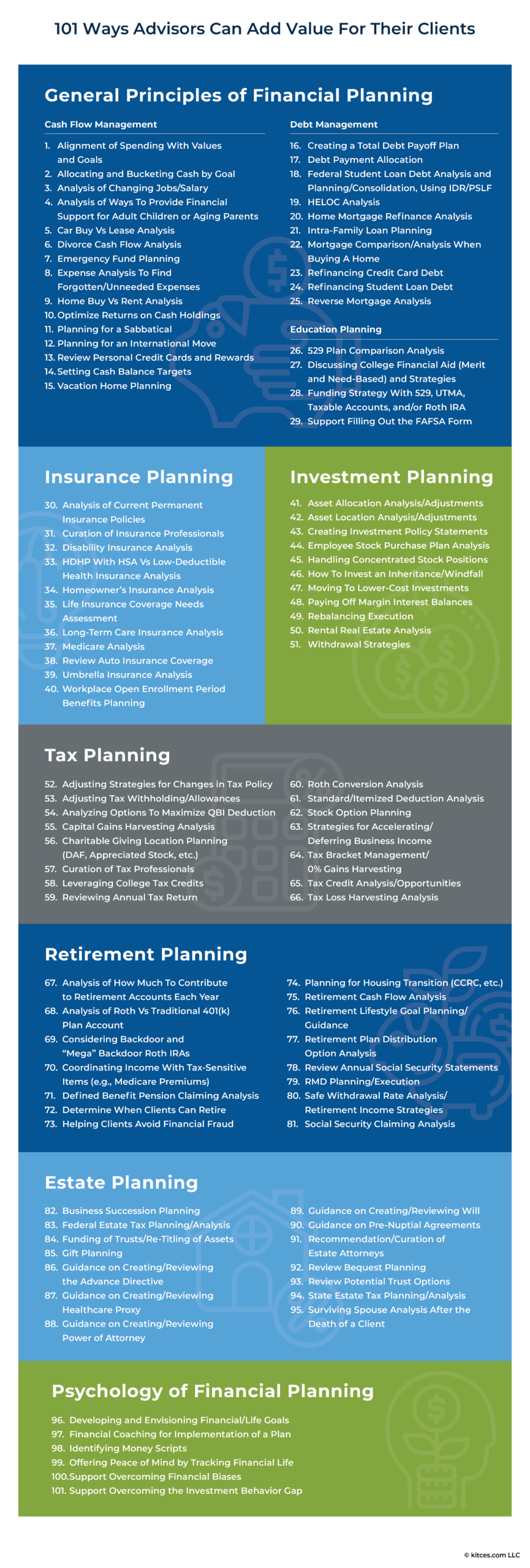

Financial experts may run their own firm or they could be component of a larger office or financial institution. Regardless, an expert can assist you with whatever from building a financial strategy to spending your cash.

9 Simple Techniques For Fortitude Financial Group

Take into consideration dealing with a financial consultant as you produce or change your financial strategy. Locating an economic expert doesn't have to be difficult. SmartAsset's free tool matches you with as much as three vetted economic experts that offer your area, and you can have a cost-free initial telephone call with your consultant matches to make a decision which one you feel is right for you. Examine that their certifications and abilities match the services you desire out of your consultant. Do you desire to learn even more about monetary experts?, that covers principles bordering accuracy, dependability, editorial self-reliance, know-how and objectivity.Lots of people have some psychological link to their money or the points they buy with it. This psychological link can be a primary factor why we might make poor economic choices. An expert financial consultant takes the emotion out of the formula by offering objective advice based upon knowledge and training.

As you go via life, there are economic choices you will certainly make that could be made a lot more conveniently with the guidance of an expert. Whether you are attempting to lower your financial debt tons or wish to begin planning for some long-term goals, you might benefit from the solutions of an economic advisor.

Fortitude Financial Group Things To Know Before You Get This

The basics of financial investment management consist of acquiring and offering financial assets and various other financial investments, however it is a lot more than that. Managing your investments entails recognizing your brief- and long-term goals and making use of that details to make thoughtful investing decisions. A monetary consultant can supply the information required to help you diversify your financial investment profile to match your see page desired degree of danger and satisfy your monetary goals.Budgeting provides you an overview to just how much money you can spend and just how much you need to conserve every month. Complying with a budget will assist you reach your brief- and long-lasting financial objectives. A financial expert can assist you outline the activity steps to take to set up and preserve a spending plan that benefits you.

Often a medical bill or home repair can all of a sudden include in your financial obligation load. An expert financial debt administration strategy helps you settle that financial debt in the most monetarily beneficial means possible. An economic consultant can help you evaluate your financial obligation, focus on a financial obligation payment strategy, provide options for debt restructuring, and outline a holistic strategy to much better handle debt and satisfy your future economic goals.

The 9-Minute Rule for Fortitude Financial Group

Individual capital evaluation can inform you when you can afford to purchase a new automobile or just how much money you can include to your cost savings monthly without running short for needed expenditures (Investment Planners in St. Petersburg, Florida). An economic expert can aid you plainly see where you spend your cash and after that use that understanding to assist you comprehend your economic health and exactly how to enhance itRisk management services recognize possible risks to your home, your vehicle, and your family, and they help you place the right insurance plan in position to reduce those dangers. A financial advisor can assist you develop a method to safeguard your gaining power and decrease losses when unforeseen points happen.

The smart Trick of Fortitude Financial Group That Nobody is Talking About

Decreasing your tax obligations leaves even more money to add to your financial investments. Financial Resources in St. Petersburg. A monetary advisor can assist you utilize charitable offering and investment strategies to decrease the amount you have to pay in tax obligations, and they can show you just how to withdraw your money in retirement in a way that likewise lessens your tax obligation problemEven if you really did not start early, university planning can aid you put your youngster with college without facing unexpectedly large expenditures. A financial advisor can guide you in understanding the most effective ways to save for future college prices and how to fund potential spaces, discuss exactly how to reduce out-of-pocket college prices, and encourage you on qualification for financial assistance and gives.

Report this wiki page